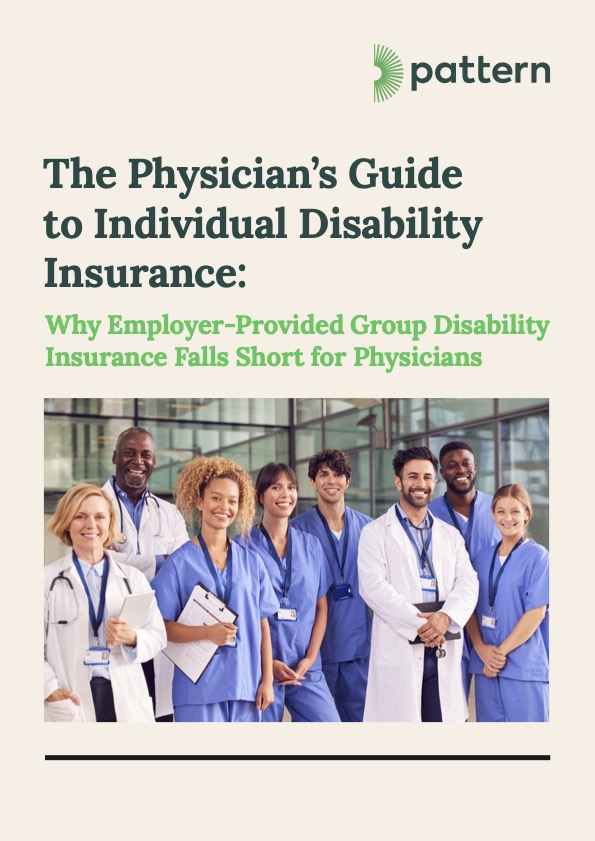

The Physician’s Guide to Individual Disability Insurance

Why Employer-Provided Group Disability Insurance Falls Short for Physicians

Your ability to practice medicine is your greatest financial asset. If injury or illness prevents you from working, disability insurance replaces a portion of your income—critical for covering student loans, mortgages, family expenses, and retirement savings. For physicians, own-occupation coverage is essential, ensuring you receive benefits if you can’t work in your specific specialty, even if you can work elsewhere.

Many doctors rely on employer-provided group coverage, but these policies often leave gaps and aren’t portable if you change jobs. Individual own-occupation policies offer stronger, more tailored protection that follows you throughout your career.

There’s a good reason more than 30,000 doctors over the last 10 years have trusted Pattern to help them quickly find the right policy at the best price:

We are committed to empowering you with the knowledge and resources you need to make the best insurance choices for your career and future.

Individual vs. Group Disability: How Do They Stack Up?

Individual

✅ Customized & Tailored to You

✅ True Own-Occupation Coverage

✅ Full Benefit Amounts

✅ Full Control Over Your Policy

✅ Tax-Free Benefits

Group

❌ Standardized Plans

❌ Unfavorable Policy Provisions

❌ Reduced Benefits

❌ Coverage Tied to Employment

❌ Taxable Benefits

Customizable Coverage Tailored to Early-Career Physicians

With these customization options, individual disability policies offer higher benefits and greater flexibility than group policies, typically one-size-fits-all.

You can also enhance your policy with other provisions:

Return of Premium:

A feature that refunds a portion of your premiums if no claims are made over a certain period.

Waiver of Premium:

This exempts you from paying premiums after being disabled for 90 days.

Elimination Period Customization:

You decide how long you wait before receiving benefits after a disability, offering flexibility in structuring your policy.

Favorable Policy Terms and Definitions

With these customization options, individual disability policies offer higher benefits and greater flexibility than group policies, typically one-size-fits-all.

Consistent and Reliable Benefits:

With individual disability insurance, premiums and benefit amounts remain consistent. Group policies, on the other hand, may have fluctuating definitions of disability or coverage limits, which could reduce the benefits you receive. Individual policies, however, offer clear, well-defined terms that minimize the risk of surprises if you need to file a claim.

Full Control Over Your Coverage:

Because you own your individual policy, you won’t lose your coverage if you change jobs—a critical advantage for physicians in a field where over 50% leave their first job within five years. Your individual disability insurance moves with you, providing stability throughout your career, no matter where you practice.

Keep All Your Benefits:

If your benefits are from a private disability insurance policy, then the benefits are typically not taxable. Why? Because the premiums are usually paid with after-tax dollars. Freedom from income taxes on benefits means more income in your pocket and greater financial security if you cannot perform your specialty.

The Advantages of Partnering with an Independent Advisor

Partnering with an independent broker, like Pattern, who represents policies from multiple companies, is the easiest and most advantageous way to shop for individual disability insurance.

When comparing coverage and costs, an independent broker plays a crucial role. With no allegiance to any specific insurance carrier, they offer objective advice and a wide range of options, helping you find the best policy that aligns with your unique needs, career trajectory, and financial goals.

Acting as your advocate, Pattern maximizes your purchasing power and simplifies decision-making— all without ever charging you directly. You only pay for your policy when you’re ready to purchase, with no added fees from Pattern.

At Pattern, we make the process simple. You can secure customized coverage that fits your unique needs—no hassle, no confusion. We know your time is precious, so we’ve streamlined everything to save you time and give you peace of mind. Don’t leave your financial future to chance.