Disability insurance is designed to protect your income in the case of an unfortunate event. Happily, disability insurance for doctors is more affordable than you might have thought.

One of the most commonly asked questions that we receive is “How much does disability insurance cost?”

Although we’d love to give you a straight dollar amount, insurance is a little more complex than that. In this chapter, we’ll talk about:

How much you can expect to pay for disability insurance

How much disability insurance coverage you need

When is the best time to get disability insurance

When you can stop paying for it

How to see your quotes

Each of these points can directly affect how much you can expect to invest in protecting your income with disability insurance.

How Much Does Disability Insurance Cost

By now, you understand how important and vital disability insurance is to your financial future. When looking into the cost of disability insurance there is a short answer and a long answer.

Short Answer:

Disability insurance costs an average of 1-3% of your annual salary.

.

Long Answer:

The cost of disability insurance can vary from person to person depending on your:

Income

Benefit Period

Coverage Amount

Medical History

Age

Health

Occupation

Discount

Location

Features and Benefits

To better understand how much you can expect to pay we will cover each of these individually.

Income

Income is one of the most crucial determining factors on how much your physician-specific policy will cost.

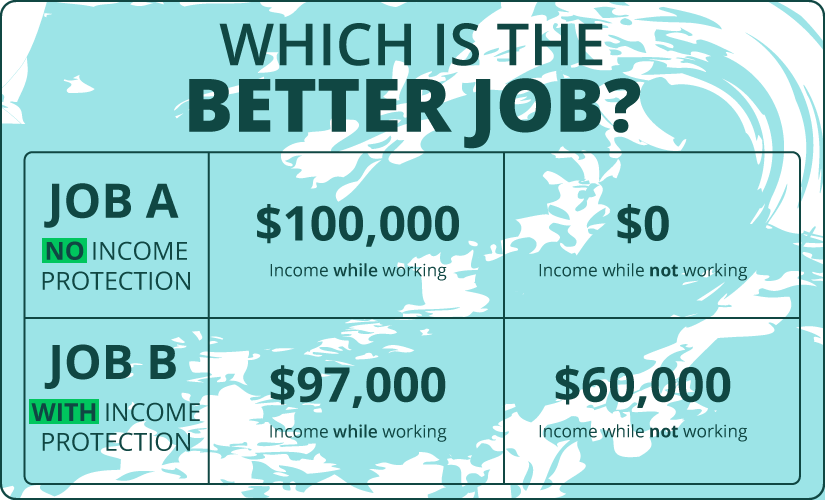

Typically, you can expect to pay between 1-3% of your annual salary. The goal of disability insurance is to replace your take-home pay if you were unable to work.

That means your income directly affects the coverage amount that you will receive, so the higher your income the higher your benefit amount and the more you can expect to pay.

Benefit Period

The benefit period is how long your benefit will last, or how long you will be paid if you become disabled.

The benefit period can range from two years or to retirement. The longer the benefit period the more your premium will cost.

Coverage Amount

When thinking about how much coverage you are going to need you should try to determine how much money you would need every month to keep up your lifestyle with no dramatic changes.

The amount you calculate can help determine your ideal benefit amount. Coverage amounts can also be determined based on your group coverage benefits as well.

How much coverage do you need?

It is recommended that you purchase the maximum amount of coverage you are eligible for in order to fully protect your income.

Something to keep in mind is that your benefit will not be taxed, though your premium will be.

That means you should set your coverage amount to 60% of your annual salary, which will end up amounting to approximately 100% of your take-home pay.

Medical History

When applying for disability insurance you will need to go through medical underwriting, which is a process where the insurance company can review your medical history.

In some cases, a medical condition can raise the rates of the premium due to the risk of the condition.

Age

Your age can be one of the most important determining factors for your disability insurance cost because typically speaking the younger you are, the healthier you are.

This is something to keep in mind when you are deciding when is the best time to purchase your policy, you will never get it any cheaper than you will today!

Health

Health is something that can determine your cost as well. The healthier you are, the lower your cost will be.

This is why we recommend you eliminate bad habits like smoking or drugs before you apply.

Occupation

Not only does your occupation affect the cost based on income but it can also affect the price you will pay due to the risk of your job.

Specifically, in the medical industry, certain specialties will have higher premiums due to the specific duties of the occupation.

This means the more likely you are to get disabled because of your occupation, or the more likely you are to be deemed disabled due to your occupation, the higher the cost.

In some occupations, a minor injury could cause a disability, because of their specific duties. Such as a surgeon, a minor injury could cause the individual to be deemed disabled due to the inability to perform their specific tasks.

This would be an example of when the rates would increase dramatically due to a higher risk of becoming disabled.

Discounts

Discounts are a great way to lower your cost of disability insurance. The most common way to get discounts is through your training program.

Training discounts are huge because they can range anywhere from 10-40% of the premium and they will last the life of your policy.

This can end up saving you a large amount over the lifetime of the policy, which is why it is so important to take advantage of those discounts when you are in training!

Another common discount is the Mental Nervous Rider Discount. Back in Chapter 3, we talked about the mental nervous rider, if you haven’t read chapter 3, go back and read it here.

If you choose to go without the mental nervous rider, it will go on your policy as a 5-10% discount.

Another great way to receive a discount is by applying with a group! This qualifies you for the Multi-Life discount which can save you up to 30% on your premium.

All of these discounts can really add up and end up saving you hundreds monthly!

Limits

Something to remember is that when you are in training you will be earning less than your future attending salary.

For this reason, companies often will put a limit on the amount of coverage you can purchase.

In residency/fellowship = $5000/month

In residency/fellowship but graduating within 6 months = $6500/7500 (depending on specialty)

Attending = income/contract determines the amount eligible. Up to $20,000/month with one single company.

Once you are attending you are able to increase your coverage amount in order to protect your full income amount.

These limits are a great way to take advantage of your training discounts while also keeping your premium payments at a low cost.

Location

Prices for disability insurance can vary between different states. This is determined by the number of claims filed in each state.

Although there are no huge jumps between every state, the states that will have higher costs are California, Nevada, Texas, and Florida.

Features and Benefits

In chapter 3, we discussed the importance of features and benefits like Residual/Partial Disability, Catastrophic Disability Rider, Cost of Living Rider (COLA), and more.

If you haven’t read chapter 3, you can read it here to fully understand the different features and benefits you can add to your policy in order to make it specific for you and your situation.

Each of these features and benefits has the potential to increase your premium since they are adding value to your policy.

How Much Can I Expect to Pay Examples:

The best way to determine an estimate of what you as a medical professional will pay for disability insurance before getting your own quotes is to look at examples.

The following two examples will walk you through a hypothetical of two doctors and the prices that their policy would cost at different times of their lives.

Doctor Carl

Doctor Carl is a cardiologist in New York. He has a clean medical record with no prior injuries and is a nonsmoker. He is applying for a policy with a benefit amount of $5,000.

Scenario 1:

In his last year of residency, 31-year-old Carl decided to get disability insurance because he knew his training discounts would be ending soon.

With his benefit amount of $5,000 and his clean medical record, along with his discounts, his total annual premium comes to $1,657.80.

Scenario 2:

After graduating and starting his attending position, Carl decides to look into getting disability insurance.

At the age of 33 with a clean medical record and a $5,000 monthly benefit, his total annual premium comes to $2,007.75.

Without his training discounts, his premium increased by almost $400 a year!

Scenario 3:

Now that Carl is set in his career, he has decided that he would like to invest in disability insurance.

He is now 41 and is still in good health. For a $5,000 monthly benefit, his total annual premium comes to $2,741.82.

Due to his age and lack of training discounts, his policy premium was increased by almost $1,100!

Getting a policy while you are still in training can save you a lot of money in the long run.

So when considering the best price and the best time to buy your policy, keep this in mind.

“How much does disability insurance cost” is not an easy question to answer because it is so specific to each individual.

By taking five minutes to fill out a quote request you can see what you would pay for your medical professional specific policy. If you are ready to get your quotes, fill out a quote request here!