Quickly Compare & Buy Physician Life Insurance

Understand What You're Buying

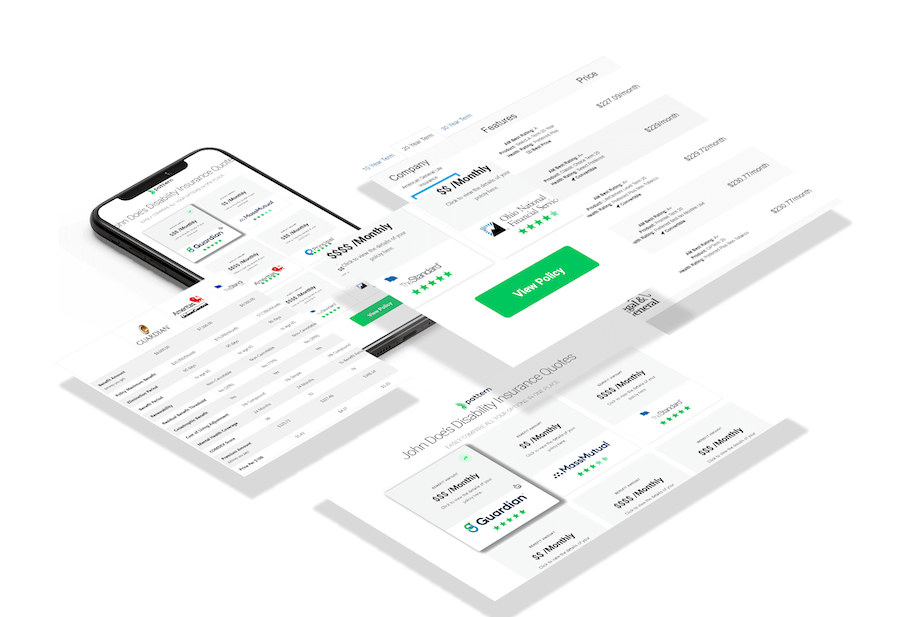

Save Time Comparing Your Options Side by Side

Discounts Available

Life insurance shopping is tedious.

Trusted by Over 20,000 Doctors

Thousands of Doctors nationwide have trusted us to help them compare, understand, and buy insurance.

How It Works

Step 1: Request Your Quotes

Fill out a simple form and we'll gather your personalized quote comparison form.

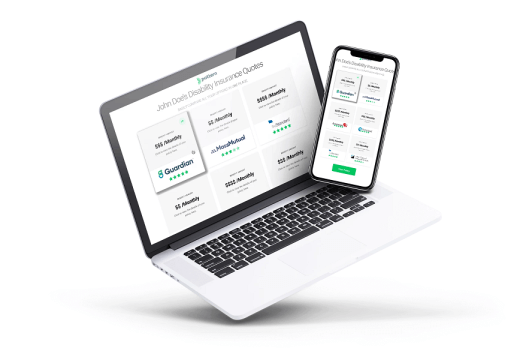

Step 2: Compare Your Options

Talk with us online to compare and understand what you're buying

Step 3: Secure Your Policy

We will handle boring paperwork so you can get back to what you'd rather be doing.

Frequently Asked Questions

Can I make changes to my disability insurance or life insurance policy?

Yes! If you want to make modifications to your application, just email your relationship manager at Pattern. Nothing is final until you sign your policy.

How are disability and life insurance rates determined?

This is based on your age, health, income, personal history, and state you practice. Once all these details are gathered, the insurance company runs an algorithm with your information to finalize a premium.

How is Pattern different from other insurance companies?

We know how it feels to get ripped off, and we know that your time is valuable. That’s why we’ve helped thousands of doctors get the financial protection they need in a fast and simple way. We’re able to do that because we’re an independent broker, which means that we can get you quotes from different companies that will help you be confident you’re getting the perfect policy for you.