Both short and long-term disability insurance replaces some varying portion (more on that later) of your income if you become ill or injured and aren’t able to work.

An important difference between the two types of disability insurance is in how they define “disabled”. If you’re ill or injured, the policy’s definition of disability will be really important to you, especially as a doctor.

As the names suggest, short-term disability and long-term disability are also distinguished by how long they’ll keep paying your income.

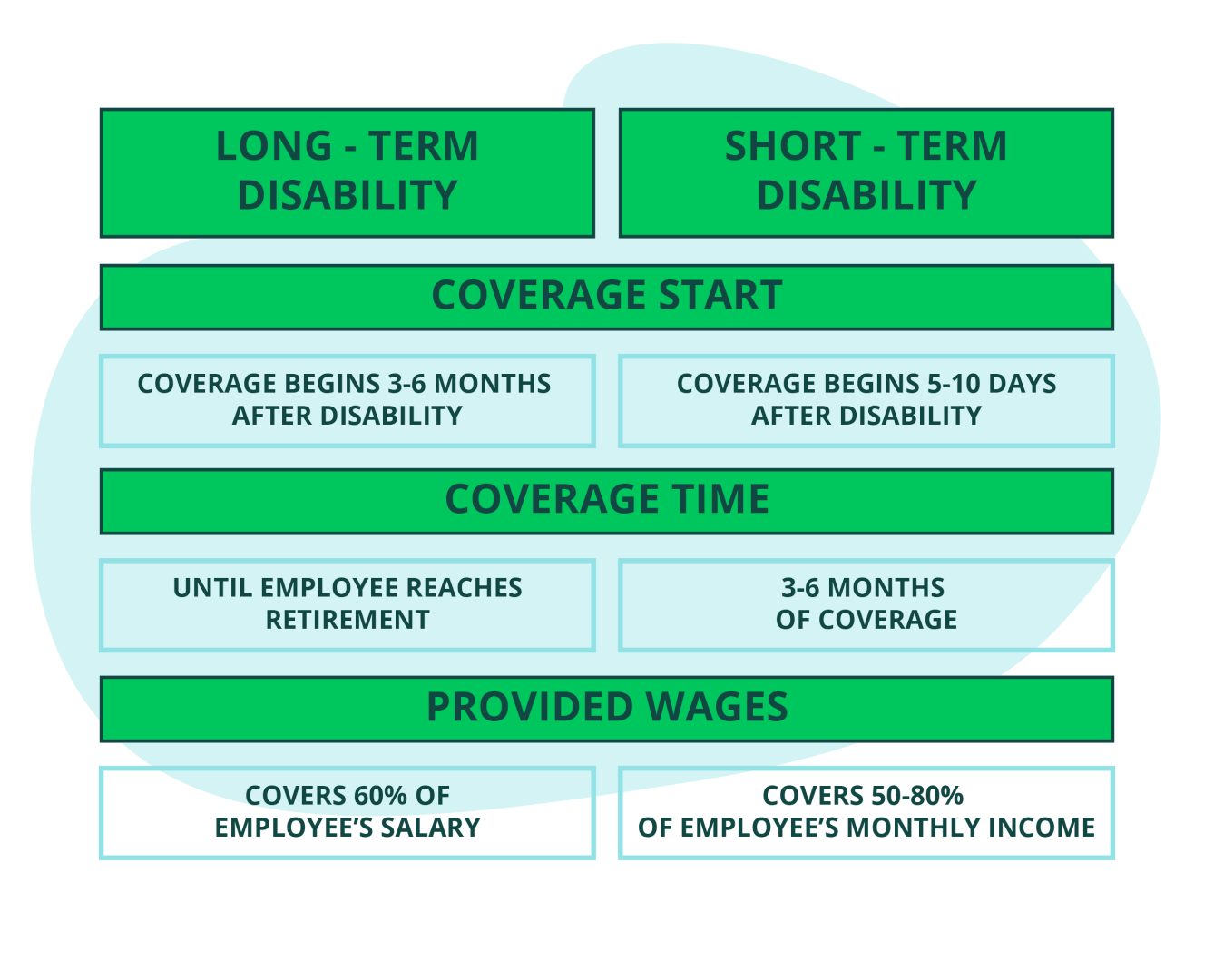

Generally, short-term disability insurance will begin roughly a week after the disability occurs and will last a few months.

After short-term coverage ends, long-term disability coverage kicks in—typically 90 days after the disability happens until either recovery or until the end of the benefit period.

.

In the image above, you can see the general timeline for short-term and long-term disability insurance.

Generally, short-term disability insurance will begin roughly a week after the disability occurs.

Following that long-term disability insurance will begin 90 days after the disability occurs.

Short-Term Disability Insurance

Short-term disability insurance usually covers you between three and six months, and typically for physicians covers things like:

Back injuries

Arthritis

Vehicle accident injuries

Childbirth

One of the most common short-term disabilities is childbirth or maternity leave. Most employers will provide maternity leave, or a third-party insurance company will provide short-term disability insurance for maternity leave. However, if your employer does not provide any type of short-term maternity leave or short-term disability insurance, you can take out your own policy before you give birth.

Short-term disability insurance will typically replace 50% - 80% of your income for the three to six months you have coverage.

The premium for short-term disability insurance can be affected by multiple factors such as:

Age

Health

Occupation

Location

Income

Many physician employers provide short-term disability insurance as part of their benefits package. One thing to keep in mind is that when your employer pays your disability insurance premium your replaced income is taxable.

And that’s usually fine for short-term recovery. But what if you have a serious illness or injury that can prevent you as a doctor from working for longer?

That’s where long-term disability insurance kicks in.

Long-Term Disability Insurance

Long-term disability insurance replaces your income if you can’t do your job duties due to an injury or illness.

It normally covers you until 65, which means it will make sure your income is still being replaced until retirement.

There are a lot of common disabilities that can hinder medical professionals' job performance, like:

Bone Breaks

Musculoskeletal Disorders

Vehicle Accidents

Mental Health Disorders

Cancer

Childbirth Complications

Long-term disability insurance will typically cover 60% of your annual gross income. It is meant to essentially replace your take-home pay prior to the disability.

And if you get your own disability insurance instead of relying only on what your employer provides, your benefits won’t be taxable.

Long-term disability insurance is so important because it covers the catastrophic type of disability that can disable you for the rest of your career. These types of disabilities won’t only keep you out of work for a few months but could prevent you as a doctor from working for years.

This chart will show you an overview of both long and short-term disability insurance and can help you compare the two.

.

Overview of Long and Short-Term Disability Insurance

Short-term disability insurance helps you during the start of an injury or illness but it usually doesn’t amount to more than a proper emergency fund.

It’s common to have some amount of short-term coverage from your employer.

If you don’t, you can shop for an individual policy or make sure you have at least a few months of expenses saved as an emergency fund.

For doctors, long-term disability insurance is especially important because your career is dependent on your ability to perform your specific job duties. And that ability can very much be affected by small disabilities or injuries that wouldn’t affect people in other careers.

While some employers will provide you with a long-term disability insurance policy, we strongly encourage you to get an individual policy for multiple reasons including the taxability of your benefits. We will dig into those specifics more in chapter 6.

Getting your own long-term disability insurance would replace your paychecks until retirement and allow you to continue living your current lifestyle.

You wouldn’t have to worry about keeping up with your everyday bills like your car payment, student loans, or mortgage.

Long-term disability insurance could save you from the stress of having to change your lifestyle due to the loss of your income. To get started with your personalized policy, fill out a quote request today! Now that you know the difference between long-term and short-term disability insurance, let’s move to Chapter 2 and talk about the most important piece of your policy: own-occupation coverage.