What’s the point in wasting your money on coverage that won’t protect you when you need it most? After all, the whole point of disability insurance is to protect you from financial risk if you lose your income due to an injury or illness. To make sure that you’re getting the right policy, you need to pay attention to its definition of disability.

Disability Definition

This is the #1 thing physicians need to pay attention to when selecting a policy and it sets apart good policies for doctors from those that should be avoided.

In order to qualify for disability insurance benefits, you have to meet the definition of disability that’s outlined in your policy.

There are a few different types of definitions of disability, including:

True own-occupation

Transitional own-occupation

Modified own-occupation

Any occupation

As a physician, you want the definition to be as broad as possible to cover any type of disability, as this is truly what you are paying for when you purchase disability insurance.

The best definition of disability is “own-occupation,” sometimes referred to as “true own-occupation.” It provides the strongest definition of disability and protection for physicians.

True Own-Occupation Definition

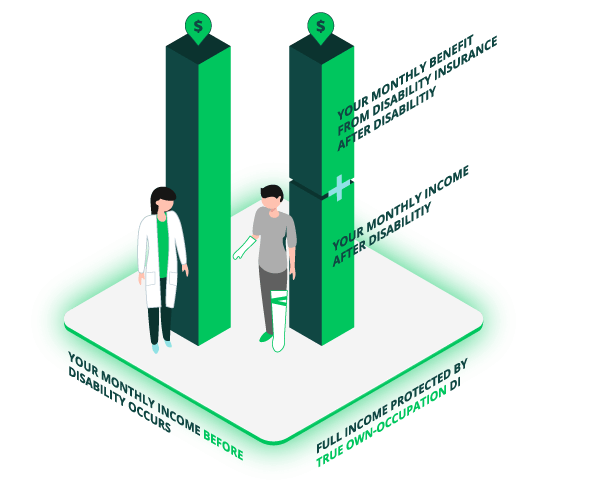

True own-occupation pays you your full benefit if you can’t perform your specific duties or specialty, even if you’re employed somewhere else.

Essentially, the true own-occupation definition means that if you can’t work in your medical specialty but are able to work in another area, you’ll still be considered disabled and get your full benefit payout.

An example is a cardiovascular surgeon who can’t perform surgery but can still work as a general cardiologist or teacher. Even though they’re still working, the fact that they can’t work as a surgeon means they get paid the full benefit.

The language of each contract can vary, but an example of the language you should be looking for would be:

“You are not able to perform the material and substantial duties of Your Occupation. You will be Totally Disabled even if you are Gainfully Employed in another occupation so long as, solely due to Injury or Sickness, You are not able to work in Your Occupation.”

To a physician, the definition is the most important part of the contract, especially for doctors!

We actually have stories of doctors who had an own-occupation policy and became disabled.

They then found a new passion by using their medical training to teach or research.

Normally they would not be able to make close to the same salary, but because they had an own-occupation policy they were able to find something else they loved without stressing about finances.

There are currently five insurance companies that carry the physician-specific true own-occupation definition in their policy contract. We will discuss these specific companies further in chapter four.

There are a few other definitions of disability that can be confused or even mistakenly sold as true own-occupation to doctors.

These policies will not continue to pay you your full benefit if you can perform other jobs, even if they are lower-paying

These definitions of disability include:

Transitional own-occupation: with this definition, your policy will pay benefits similar to a true own-occupation policy with one important caveat.

If you can’t work in your specialty and you start earning an income doing something else, your total net income (including benefits) cannot exceed the total original earned income of your former job.

An example of the language a transitional own-occupation definition would use could look something like this:

"You will continue to receive disability benefits if you become totally disabled in your occupation, but are working in another occupation. Benefits will be paid up to 100% of your prior earnings, but will not exceed the total monthly benefit."

With transitional own-occupation, they will generally cover your income up to the point of your income before the disability.

This is definitely easier to explain with an example. Let’s say prior to your disability you were making $11,000 a month, and after your disability, you began working as a teacher and earned $6,000 a month.

Your transitional own-occupation policy would then pay you a $5,000 monthly benefit and you would continue to receive your $6,000 monthly income from teaching, making an $11,000 monthly income.

Essentially, with a Transitional Own-Occupation policy, you can start a new career while still getting your benefit. The difference is that the company will only pay the gap between your old monthly take-home income and your new monthly take-home income.

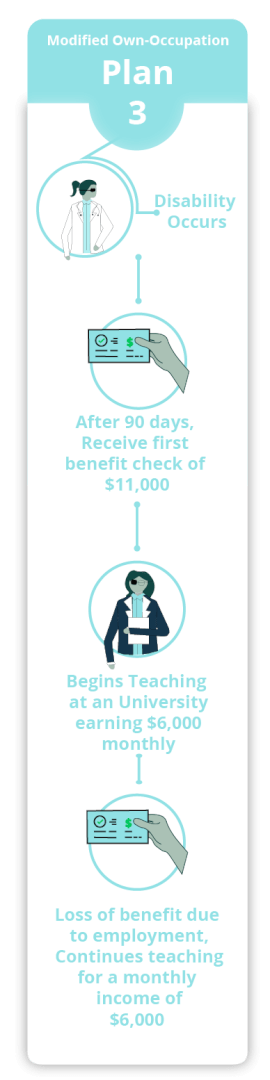

Modified own-occupation: According to this definition, a person receives benefits when they can’t work in their own-occupation and are totally disabled.

However, benefits do not continue if that person wants to work in another profession.

The options of a totally disabled person with modified own-occupation coverage would be to either live off their benefit check or to go back to full-time work in a different occupation without their disability benefit.

Within a modified own-occupation Policy, the language that you would be seeing for the definition of disabled would contain language like:

“The Insured is totally disabled when both unable to perform the principal duties of the regular occupation and not gainfully employed in any occupation.

If the insured can perform one or more of the principal duties of the regular occupation, the insured is not totally disabled.”

Any occupation: we definitely don’t recommend that doctors get an any-occupation policy.

This is the most common disability definition and is usually found in employer group plans and low-cost individual policies.

Under an any-occupation policy, you’re only considered disabled if you can’t work in any occupation that you could be considered reasonably suited for based on education, training, or experience.

This is the least beneficial type for you, and also gives the greatest leverage to the insurance company.

Often the only way to receive your income benefit at all is if you’re unable to work, period.

An example of the wording of the definition of disabled in an Any Occupation Policy would look like this:

"You are unable due to illness or injury to perform the material and substantial duties of any occupation for which you are fitted by education, training, and experience"

In some cases, if you’re able to work in another industry and there are open positions that you’re qualified for, even if you don’t apply for them, you’d no longer be considered totally disabled just because of the possibility that you could work at a different job.

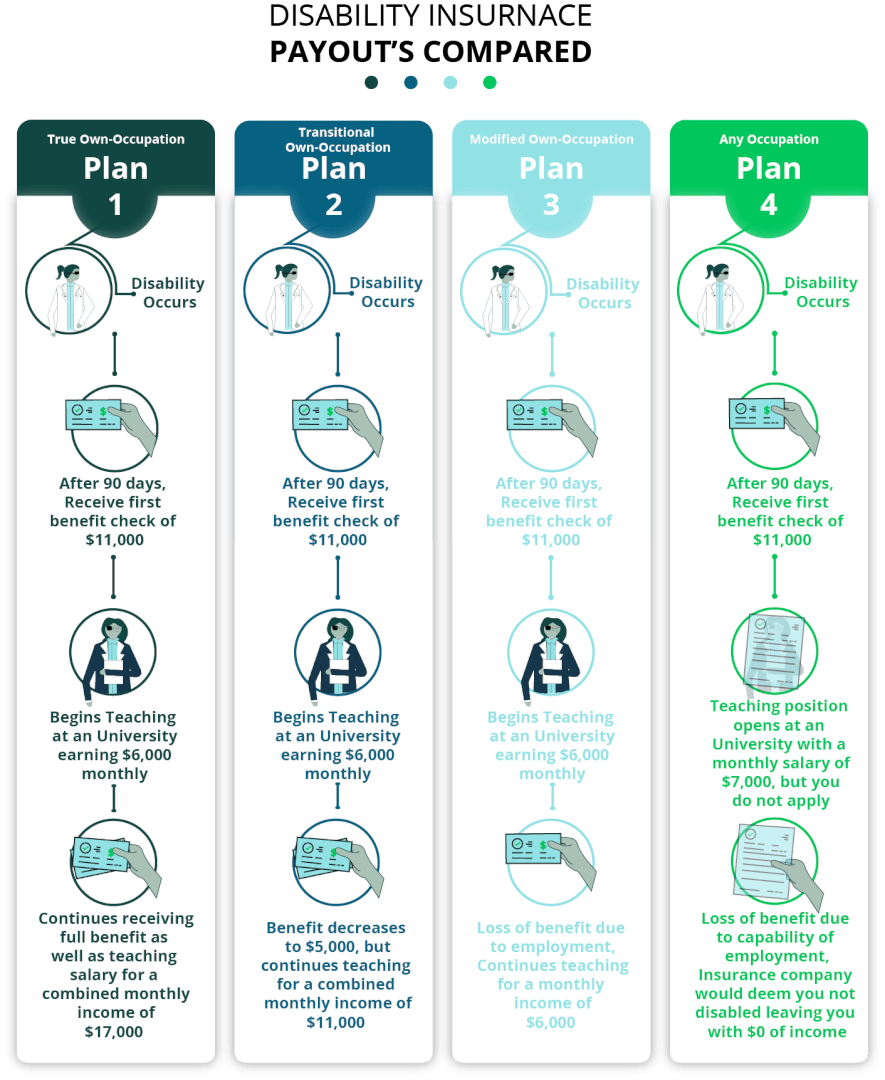

The difference between these policy types can be hard to understand with the insurance language, but they can be very extreme and crucial for you to understand when looking into your policy options. To help you better understand the differences and how they would pan out, we have laid out the same situation with the four different own-occupation policy options in the image above.

After Sally becomes disabled, she begins to receive her policy of $11,000 after 90 days.

Plan 1: True Own Occupation

After those 90 days, she applies for a teaching position at a local University, she gets the position and is now making $6,000 every month from teaching.

Because her policy is True own-occupation, she will continue to receive her full benefit and her new teaching income for a total monthly income of $17,000

Plan 2: Transitional Own-Occupation

After those 90 days, she applies to teach at a local University and gets the position making $6,000 monthly.

Due to her transitional own-occupation policy, her benefit decreases to $5,000.

She continues teaching making a combined monthly total of $11,000.

Plan 3: Modified Own-Occupation

After those 90 days, she applies for a position as a professor at a local University and gets the position.

With her new monthly paychecks of $6,000 from teaching, her Modified Own-Occupation policy cancels her benefit.

Leaving her with her new teaching position income for a monthly income total of $6,000.

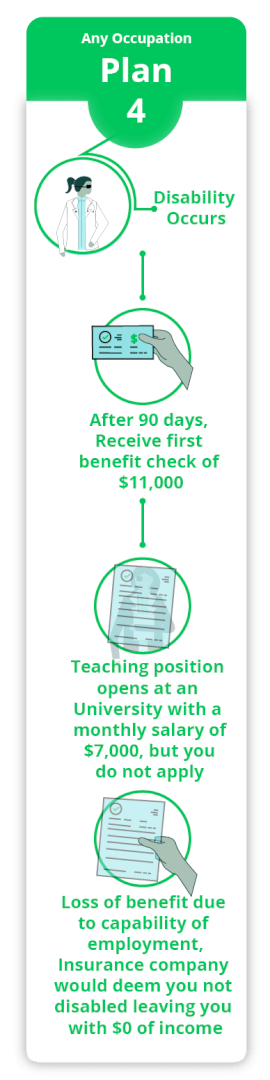

Plan 4: Any Occupation

After those 90 days, a teaching position opens at a local university and Sally meets all of the qualifications, however, she is enjoying her free time and decides not to apply.

Due to her Any Occupation policy, the company deems her not disabled because she is capable and qualified for the teaching position.

She ends up losing her policy and now has a monthly income of $0.

As you can see from this example, the best option for medical professionals is the True own-occupation policy because it allows you the choice to do something else without being punished for it, whereas the other policy types each have a consequence of getting another job, or in Plan 4’s Any Occupation case, having a possibility of a new job.

True own-occupation is the only definition of disability insurance that we encourage medical professionals to purchase because it is the most comprehensive and will allow you the option of working in another field if you are unable to work in your medical specialty.

When shopping for a policy, getting a physician-specific “own occupation” definition is always the first and most important thing to consider. The financial security of disability insurance is so important for doctors' financial security. If you are ready to get started with your own-occupation coverage policy today, fill out a quote request!

Now that you know the importance of own-occupation coverage, we can start talking about riders and benefits that can help you build your best policy.